Investor Personality Quiz

Personality matters when it comes to how you invest your money.

The BC Securities Commission conducted the National Smarter Investor Study among Canadians aged 35+ to assess what Canadians know, feel, and do when it comes to investing.

This study also introduced a new way of understanding investing behaviour — Personality. It identified five distinct personality types among survey takers, each representing a common set of traits known in academic circles as the “Big 5” personality traits. This research showed that personality matters when it comes to how you invest, and is the basis of the Investor Personality Quiz.

Investor Personality Quiz

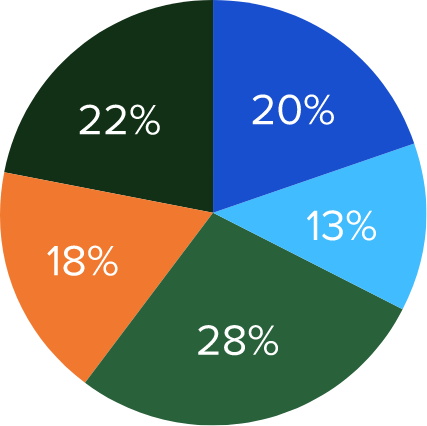

Personalities

Confident

Confident people score themselves high on all five personality traits — extroversion, agreeableness, emotional stability, conscientiousness, and openness to experience. They are most likely to work with an investment advisor, most likely to have conducted a background check on their advisor, and most likely to have asked their advisor how they are compensated.

Diligent

People with a diligent personality type score themselves high on all traits, except extroversion. They’re similar to the confident personality type—conscientious, open to experience, agreeable, and emotionally stable—except introverted. Diligent types are likely to work with an investment advisor, but tend not to ask how their advisor is compensated. They are the most likely of all personalities to read their investment statements and to read them all the way through.

Impulsive

Impulsive personality types score themselves high on agreeableness, lower on emotional stability and conscientiousness, and above average on both extroversion and openness to experience. Only somewhat likely to work with an investment advisor, they are the most likely of any personality to have never asked their advisor about compensation or read their investment statements all the way through.

Reserved

Reserved personality people score themselves below average on agreeableness and emotional stability and lowest of all personalities on extroversion and openness to experience. But they make up for it with above average conscientiousness. No wonder they’re among the most likely to always read their investment statements. That said, they’re less likely to work with an investment advisor and least likely of all personalities to have conducted a background check.

Tumultuous

Tumultuous personality types like you score above average on extroversion, but lowest of all on all other traits. You are the least likely to invest and, when you do, the least likely to work with an investment advisor, refer to a financial plan, or ask whether an investment you’ve been offered is suitable for you and your risk profile. You tend not to recognize any of the warning signs of investment fraud and are the most likely to report having invested in a fraud.

The Investor Personality Quiz asks the same personality questions as the survey. It then calculates the scores of quiz-takers on each personality trait and sorts them into one of the five personality types.

Each personality is defined by an approach to investing and working with an advisor that showed up in the research. The quiz results give an overview of the strengths and weaknesses of each personality in terms of investing. We round this out with videos and other tools that can help people of all personalities become smarter investors.