Have you ever received a text or chat from a stranger? It might open with a simple “Hi” or what seems like good-natured confusion about why your number is in the person’s contacts. But these messages are anything but accidental – they’re the first step in a process intended to steer you towards a so-called “investment”. Instead of a real investment, your money disappears into the account of a fraudster.

These actions are known as “pig butchering” scams – not the most pleasant name, we know. But before you take investment advice from a new “friend” or online love interest, get familiar with the red flags of pig butchering scams so that you can avoid becoming a victim.

What is a Pig Butchering Scam?

A pig butchering scam is a type of investment fraud that lures individuals into online relationships to build trust before convincing them to invest their money in seemingly legitimate and profitable ventures. Typically, the scammers promise high investment returns within a short period. Pig butchering scammers often use stolen images and fake investment websites to convince victims of the legitimacy of their schemes. Once victims are hooked and have invested money, the scammers suddenly disappear, leaving victims with no way to recover their funds.

The term ”pig butchering” is derived from the idea that scammers fatten up their victims with the promise of lucrative returns and allowing small initial withdrawals of purported profits before “slaughtering” or “butchering” them for their money. Drawing its name from the Chinese phrase, Shāzhūpán, pig butchering scams are long-term con jobs that combine elements of romance scams, investment schemes, and crypto asset fraud.

How Does a Pig Butchering Scam Work?

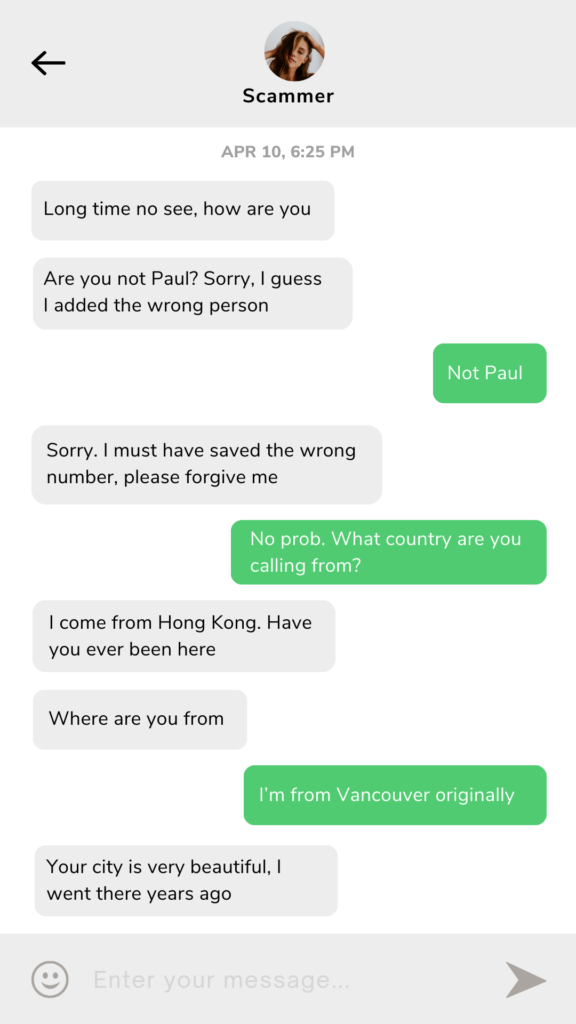

The scam often begins with a seemingly innocent chat initiated by a random person on social media platforms or WhatsApp. The scammer might claim to have received the target’s number from a mutual friend, while also appearing unsure if they have the correct number. This is just an act to engage the targeted victim in conversation. Scammers have also been known to use images of attractive women to lure victims, preying on their desire for companionship or romance to build trust and establish a connection.

As the conversation progresses, the scammer gradually introduces the fake investment scheme and promises significant profits within a short period – but only if the target invests a certain amount. After persuading the target to invest, the scammer collects the funds, often using digital payment platforms or crypto which makes recovering funds or tracking money more difficult.

Once the scammers receive money and open an account for them, it will appear the victim’s online account balances grow. The victims usually are able to withdraw at the beginning and this leads them to put in more money. Then, the scammers will suddenly become unreachable, or the brokerage platform will have trouble transferring funds.

Here’s an example of what the early stages of a text conversation between a scammer and target could look like in a pig butchering scam:

What are the Warning Signs of a Pig Butchering Scam?

Pig butchering scams use social engineering to build your trust over weeks or months. In simple terms, social engineering means tricking people into doing things or sharing personal information. If you see any of the following warning signs, break off all contact immediately.

1. “Wrong number” texts or chat messages

Like you see above, many pig butchering scams start “by accident.” Scammers send messages via WhatsApp, text, social media, or dating apps pretending they’re trying to reach someone else.

But this contact is no mistake – you’re in the crosshairs of a con artist. The message is bait, as the scammer attempts to lure you into a conversation.

Don’t respond to unsolicited text messages. Regardless of what the person is saying, you shouldn’t engage in conversation. Instead, delete the messages and block the number. Always be careful who you connect with on social media.

2. No phone or video calls

Scammers employ tactics to avoid direct communication that could reveal their true identity or intentions. One notable red flag is their reluctance to engage in phone or video calls.

By sticking solely to text-based communication, scammers create a barrier that shields them from being confronted or questioned in real-time. It’s a strategy designed to maintain control over the narrative and manipulate victims without risking exposure of their true identity or the authenticity of their claims. Exercise caution with someone who refuses to engage in phone or video calls, as it often signals a scam.

3. Love bombing

Be wary of any new online relationship that moves quickly, especially if you are promised expensive gifts or lavish vacations. The new love interest may be very personal and forward early on, sharing intimate details about their lives and expressing their love for you – the excessive attention, admiration, and gifting is like an explosion.

When it comes to online dating, you should always take things slowly until you truly know the person – which usually involves a few in-person meetings before taking things further. If you have suspicions, it’s best to end all contact and block the person on all platforms.

4. Emotional manipulation to build trust

The person texting you may talk about ambitions and goals, and encourage you to do more with your life. The person may then casually mention how much money they spend on large purchases, like cars and holidays. Scammers make these remarks in an attempt to shame you or entice you to do what they want.

They may constantly remind you of your struggles, and position crypto or other online investments as the “solution” to your problems.

If you share personal information about your life or financial situation, and the person texting starts encouraging you to invest in something, it’s a major red flag. End all contact immediately, especially if they use emotionally manipulative tactics.

5. Investment that has “guaranteed” returns

Let’s make this clear – there’s no such thing as guaranteed returns with any form of investing.

Within a few weeks of initiating contact over a dating app or text, a scammer will start talking about a highly profitable investment. They will continually bring up investing and encourage you to get involved. They promise you high returns on your investment or tell you about big gains they’ve received recently. They may then direct you to an app or website that promotes guaranteed returns.

If an investment tip or opportunity comes to you via social media or a dating app, you should stay away. Keep your personally identifiable information safe (like your social insurance number (SIN) and banking information) to avoid identity theft.

It’s just as important to be wary of friends or family members (not just online strangers) who encourage you to invest money in “get rich” opportunities because they may be unwitting victims of a pig butchering scam.

6. A “special” app or website

Pig butchering scams use fake crypto trading apps or exchanges with fake account information to make it look like you’re getting a massive return on your investment (so that you’ll keep putting in more money).

In some cases, scammers use legitimate website tools to manipulate market prices and simulate account balances, profits, or losses. Even if it seems real, any website or app can be manipulated. Never join an investment platform suggested by someone whom you’ve only met online.

7. Quick, partial return on an investment

The platform may seemingly permit small withdrawals at first. And as you invest more, the scammer may hand over communications to the platform’s “customer support”. When you try to withdraw a higher amount of money, the customer support service comes up with various excuses to stop you.

If you suspect you might be caught up in the early phases of a pig butchering scam, but are able to withdraw money, make your withdrawal immediately and stop right there. Quit while you’re ahead, and don’t invest another dollar. End all contact with the scammer, block their number, and file a complaint with the BC Securities Commission (BCSC) immediately.

8. Withdrawal fees or taxes

Pig butchering scammers try to get as much money out of you before you discover their scheme. One way they can get more is by claiming you need to pay bogus fees and taxes to withdraw your earnings.

You may receive notifications that your account is frozen and you will lose money if you don’t pay fees. The platform’s “customer support agents” explain there are processing, lending, or compliance fees. They claim you may face an exorbitant tax, which cannot be deducted from your profits.

All excuses, fees, and stalling are part of the ruse to get you to continue investing. It’s a scam, and the only thing you can do at that point is cut your losses and report the scam to the BCSC.

What do you do if you Suspect a Pig Butchering Scam?

- Break off all contact with the scammer. Effective immediately, stop all communications across text, social media, apps, and email. Don’t send any explanation or say goodbye.

- Block and report their account. It’s common for scammers to use multiple online friends of the host to add credibility to the long-term scheme. Make sure to report every profile that might be part of the scam.

- Change all your passwords and login credentials. If you share any account numbers or access codes for your investment accounts or trading platforms, you’ll need to create new, complex passwords that aren’t easy to hack.

- File a police report. You can inform your local law enforcement office with full details of the fraud.

- File a complaint with the BCSC. It helps to include specific details and any supporting documents like screenshots of email, text, and other online conversations.

- Monitor your financial accounts for signs of fraud. Keep a close eye on all your investment accounts, bank accounts, and credit card statements and look for unfamiliar transactions.

How to Protect Yourself From Pig Butchering Scams

- Never share your personal information with people you’ve only met online, including your SIN and investment and bank credentials.

- Never send money or crypto to anyone you haven’t met in real life or don’t personally know and trust.

- Never join any investment site or download an app at the behest of someone you have only met online. Even if it looks and seems real, it could be a fraudulent app that scammers are controlling to give the impression that you’re earning profits.

- Remember there’s no such thing as guaranteed returns. Never believe any person or investment site that promises returns or requests minimum investment amounts.

- Don’t invest in crypto if you don’t fully understand how it works. If you need someone’s constant guidance to use crypto asset trading platforms, you should steer clear. You can check to see if the platform is registered by conducting a search on the Canadian Securities Administrators’ (CSA) National Registration Search (NRS). It’s smart to use platforms authorized to do business in Canada, as well as to avoid using platforms banned by Canadian securities regulators.

- Search online for third-party reviews and known scams related to any exchange, app, or investment platform before you get involved. You can use the CSA’s NRS to check if the person or firm selling you the investment is registered.

Can you Get Your Money Back After Becoming a Victim to a Pig Butchering Scam?

Unfortunately, the chances of getting your money back from a pig butchering scam are slim to none. Victims may also get retargeted by “recovery services” that claim to help them recover their losses. However, these companies are often fraudsters who run refund scams to hit victims a second time when they’re vulnerable.

The alarming rise and growing sophistication of pig butchering scams and their devastating impact on victims emphasizes the imperative to stay informed about and vigilant of the tactics and strategies employed by scammers. As malicious actors continue to adapt and refine their methods, it’s essential for individuals to remain proactive in protecting themselves and their investments, especially since those who are new to investing large sums are more susceptible to falling victim to such schemes. If you find yourself in a seemingly trustworthy relationship with an unknown person online that follows this scam’s patterns, it’s crucial to take a step back and evaluate if you might be the target of such a scheme.

Be aware of the risks posed by pig butchering scams and other types of investment fraud. Scammers involved in investment frauds are likely to evolve their tactics and methods when approaching victims, but their core intent will remain the same: to swindle individuals out of their hard-earned money.

In the face of these evolving threats, always exercise skepticism toward obscure private investment opportunities and prioritize well-established and mainstream investments. By doing so, you minimize the risk of falling for scams and increase your chances of earning a profit instead of losing everything.

Report a Concern

If you have any concerns about a person or company offering an investment opportunity, please contact the BCSC Contact Centre at 604-899-6854 or 1-800-373-6393, or through email at [email protected]. You can also file a complaint or submit a tip using the BCSC’s online complaint form.

InvestRight.org is the BC Securities Commission’s investor education website. Subscribe to receive email updates from BCSC InvestRight.